In today’s construction industry, general contractors (GCs) juggle countless bid invitations under tight timelines.

Two platforms often considered for this crucial task are ConCntric and Downtobid. Both aim to streamline how GCs send invitations to bid (ITBs) and manage subcontractor responses, but they take drastically different approaches.

ConCntric is a comprehensive preconstruction management suite (integrated with Autodesk’s BuildingConnected network), whereas Downtobid is a modern, AI-driven bidding tool laser-focused on automating ITBs and boosting subcontractor engagement. If you’re evaluating a ConCntric alternative or wondering “Is ConCntric better than Downtobid?”, this side-by-side comparison will help you decide.

By the end, you’ll understand the core differences in product focus, user experience, pricing, AI automation, subcontractor network access, and more.

Note: Downtobid streamlines preconstruction with AI-powered bid management. Send personalized ITBs, automatically detect scope from plans, and match with qualified local subs—all from one intuitive planroom. Boost bid participation, reduce errors, and manage multiple projects effortlessly. Click here to request a free demo.

Key Takeaways

- Approach & Focus: ConCntric is an all-in-one preconstruction platform (estimating, planning, risk management) that integrates BuildingConnected for bidding. Downtobid focuses exclusively on ITB management and coverage tracking – simpler and faster for bid-specific needs.

- Bid Invitations & AI: Downtobid's AI analyzes plans, drafts personalized invites, and matches subs (~30% higher response rates). ConCntric uses traditional manual invites through BuildingConnected with no AI-driven scoping or personalization.

- Subcontractor Network: ConCntric/BuildingConnected has 700,000+ users but relies on crowd-sourced data that's often outdated. Downtobid maintains ~57,000 verified, actively pruned subs. ConCntric wins on scale; Downtobid wins on reliability.

- User Experience: Downtobid lets GCs upload plans and send ITBs in minutes. Subs view plans without logging in via an organized, no-account planroom. ConCntric requires subs to log into BuildingConnected's cluttered interface – creating friction that reduces engagement.

- Pricing: Downtobid offers transparent monthly plans (free starter tier, free trials). ConCntric requires sales demos for custom pricing (BuildingConnected alone costs $3,600+/year). Downtobid typically delivers better value unless you fully utilize ConCntric's extensive non-bidding features.

- Pricing & Value: Downtobid offers transparent monthly plans (including a free starter tier and free trials) that make advanced bid management affordable for teams of all sizes. ConCntric, like many enterprise solutions, requires a sales demo for pricing – indicative of a premium annual cost (BuildingConnected alone is $3,600+ per year). Unless you fully utilize ConCntric’s extensive features beyond bidding, Downtobid often delivers more value at lower cost, with AI and network benefits included out-of-the-box.

What Is Downtobid?

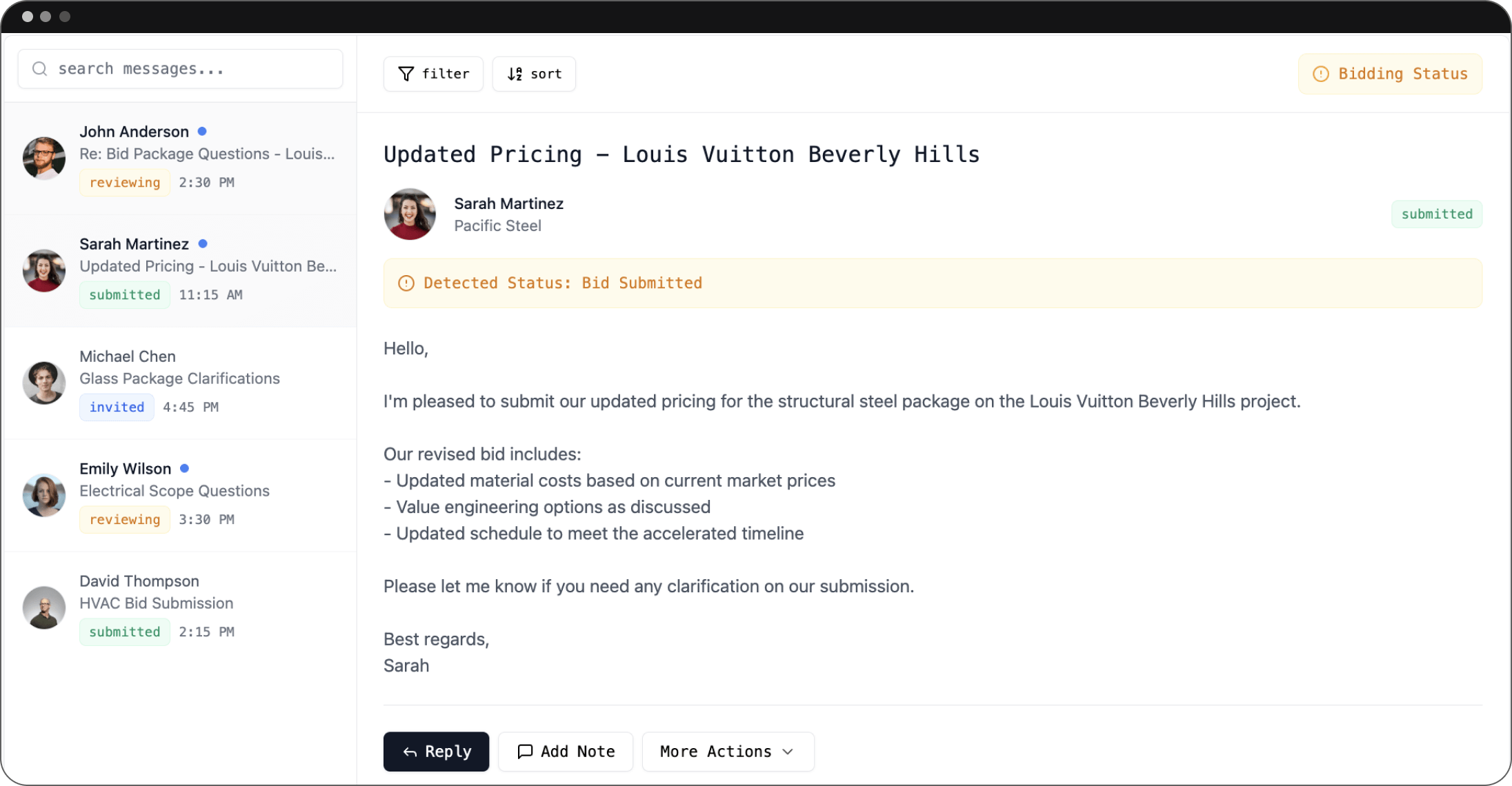

Downtobid’s interface is built for speed – GCs can turn plans into tailored ITBs with just a few clicks.

Downtobid is a modern, AI-powered construction bidding platform focused on speeding up ITB creation and improving subcontractor response rates.

Founded as a technology-driven alternative to old-school bid management, Downtobid automates the tedious parts of bidding while keeping a human touch in subcontractor communication. Instead of blasting out generic invites, GCs use Downtobid to target the right subs with relevant, personalized invitations.

Key Features Include:

- Personalized Invites: Craft context-rich email invitations that highlight each project’s scope and details for the recipient. This boosts sub engagement and avoids the “spam blast” feeling of mass emails. Many GCs see significantly higher bid responses after switching to Downtobid’s tailored outreach (often 30%+ improvements).

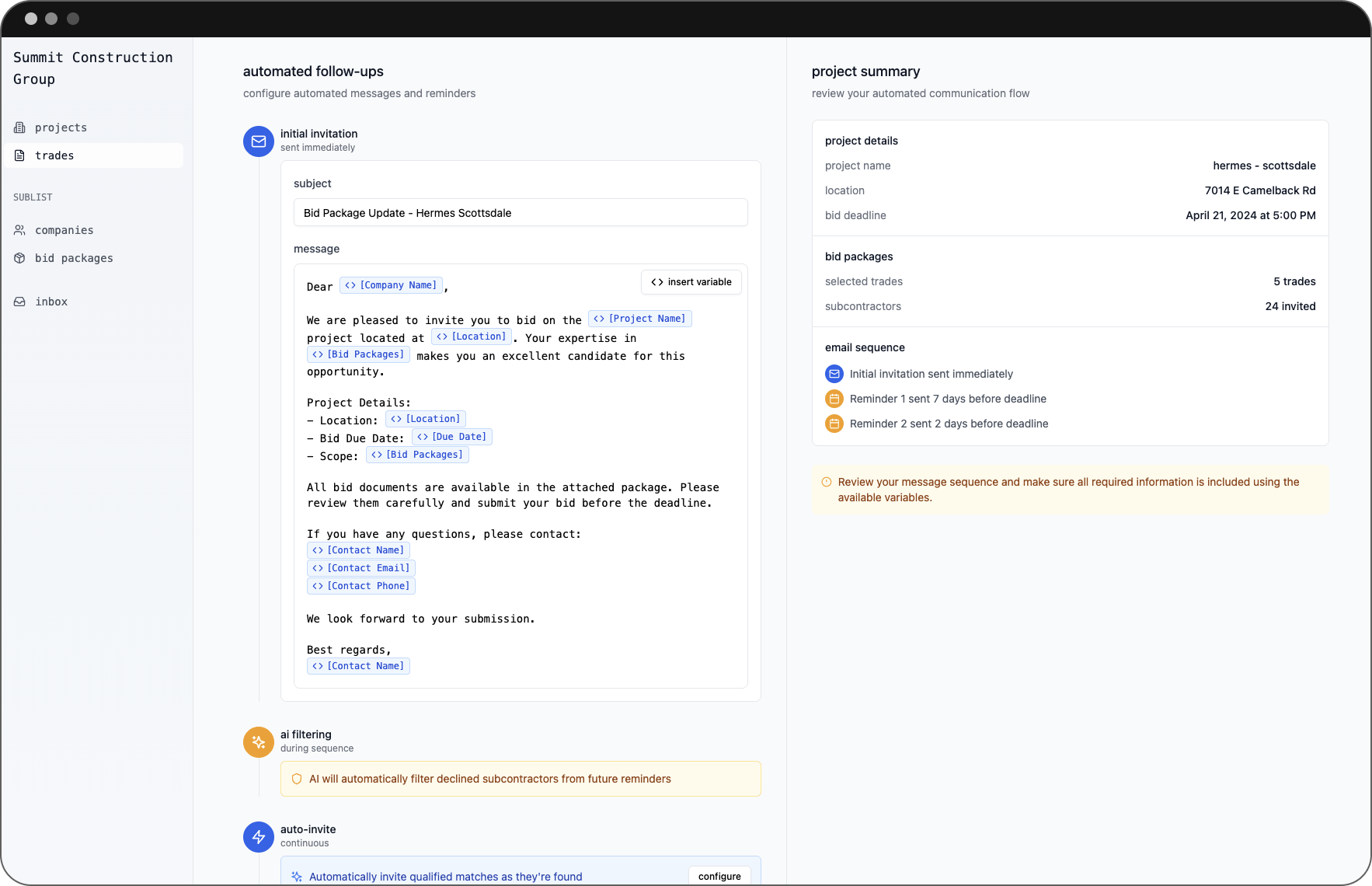

- Automated Follow-ups: Downtobid takes care of the polite nudges. The system tracks which subs opened the invite or downloaded files and automatically sends reminder emails to those who haven’t responded. GCs are saved from endless phone tag, and fewer bids slip through the cracks.

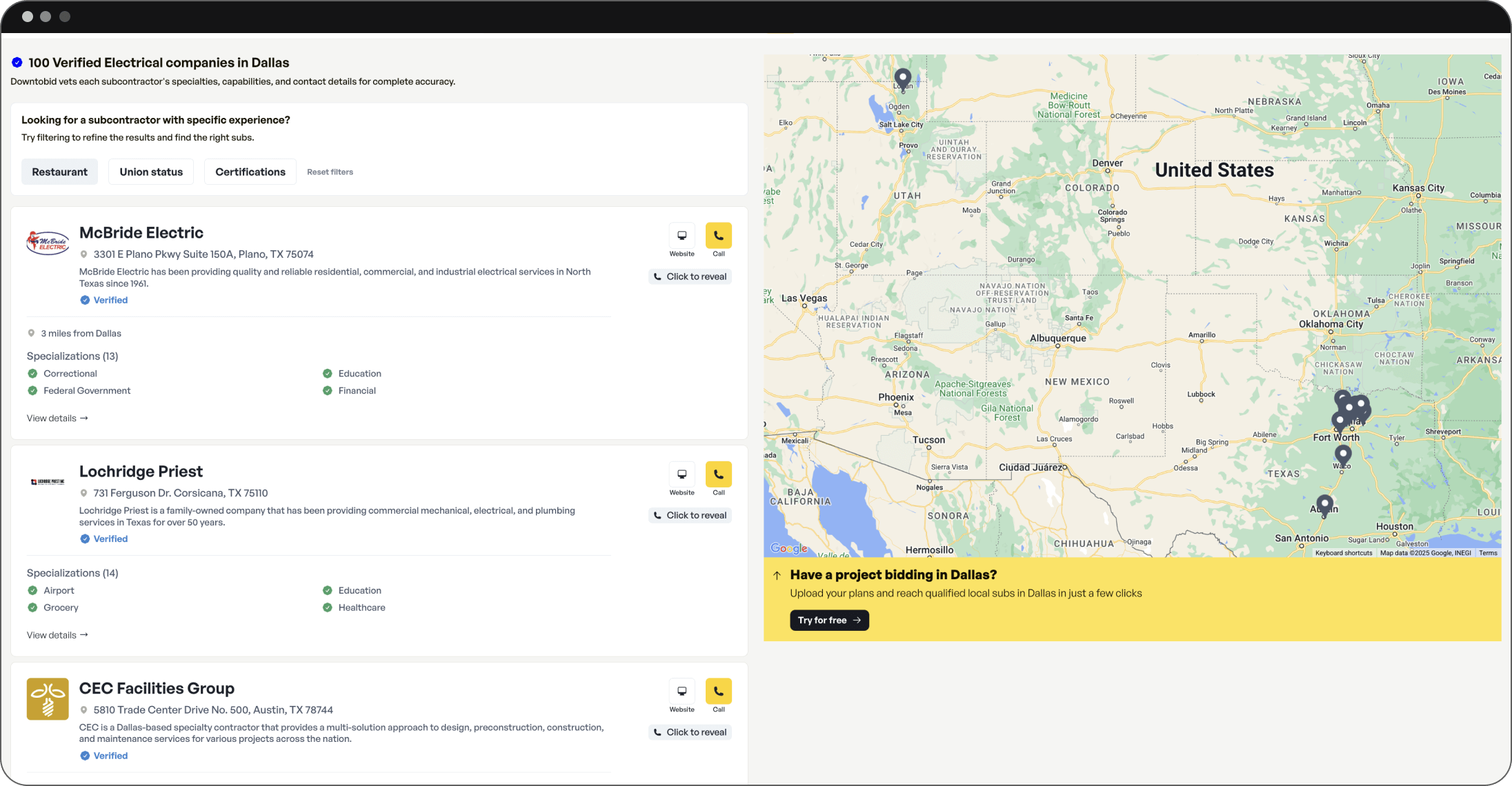

- Verified Subcontractor Network: The platform connects you with a vetted database of over 57,000 subcontractors across trades and regions. Every contact is regularly updated to filter out closed businesses or bad emails, so you’re not wasting time on dead leads. This curated network helps GCs find new qualified subs (e.g. when entering a new market) without relying on outdated directories.

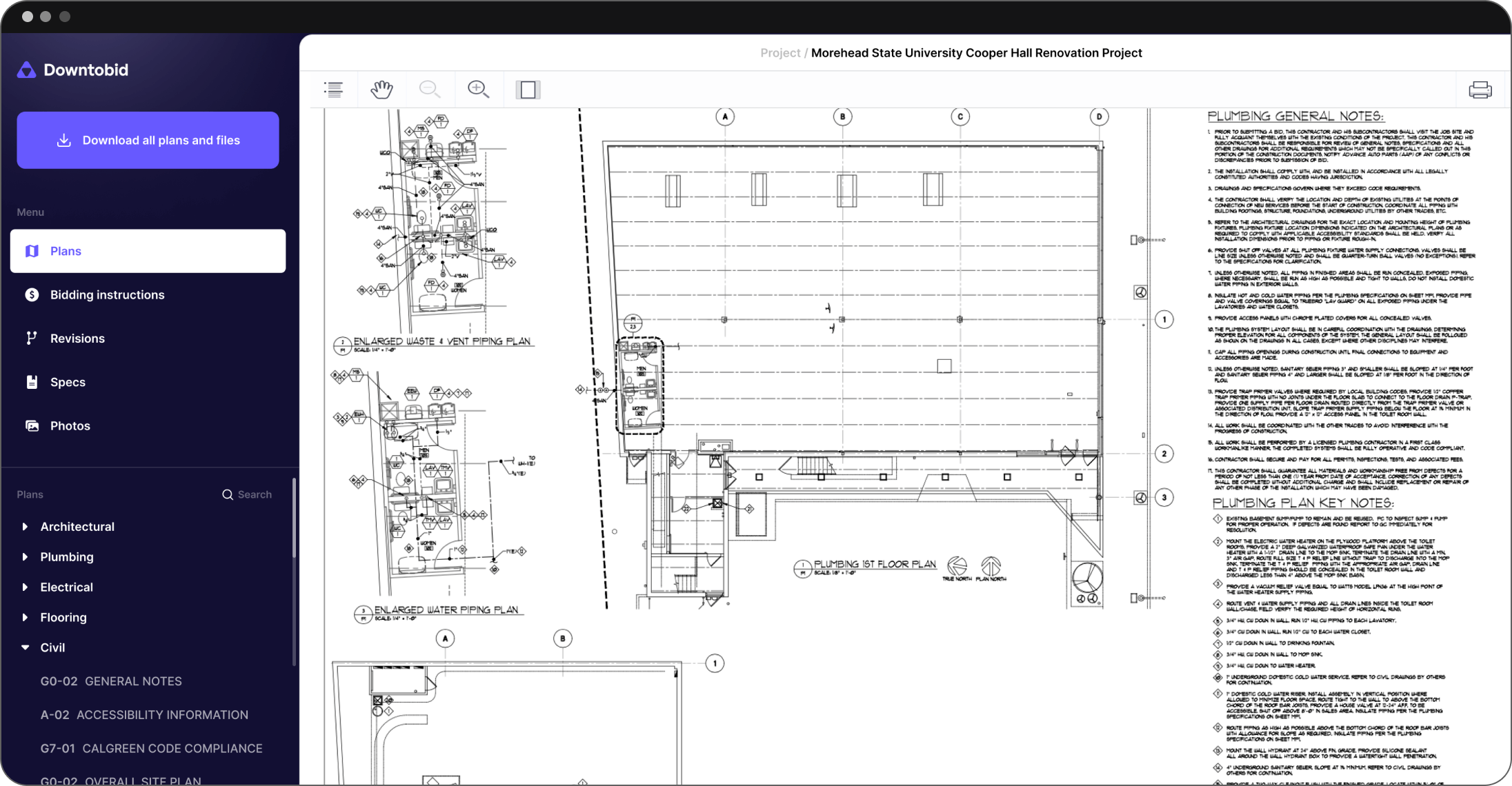

- AI-Organized Planroom: Downtobid’s “light AI” automatically sorts and indexes your project documents by trade and plan sheet, creating an intuitive planroom for subs. Subcontractors don’t need to wade through huge PDFs or confusing folders – they can quickly locate the plans/specs relevant to their trade. Better yet, no login is required to access files, removing a common barrier for subs. This frictionless experience means subs can review projects and start pricing work faster, driving up participation rates.

In short, Downtobid is laser-focused on the bidding stage of preconstruction. It doesn’t try to manage your entire project lifecycle or do detailed cost estimating. Instead, it excels at automating ITBs, tracking coverage in real time, and fostering a more responsive, hassle-free connection between GCs and subs. If your primary need is to send invites and get bids in efficiently, Downtobid keeps it simple and delivers results.

What Is ConCntric?

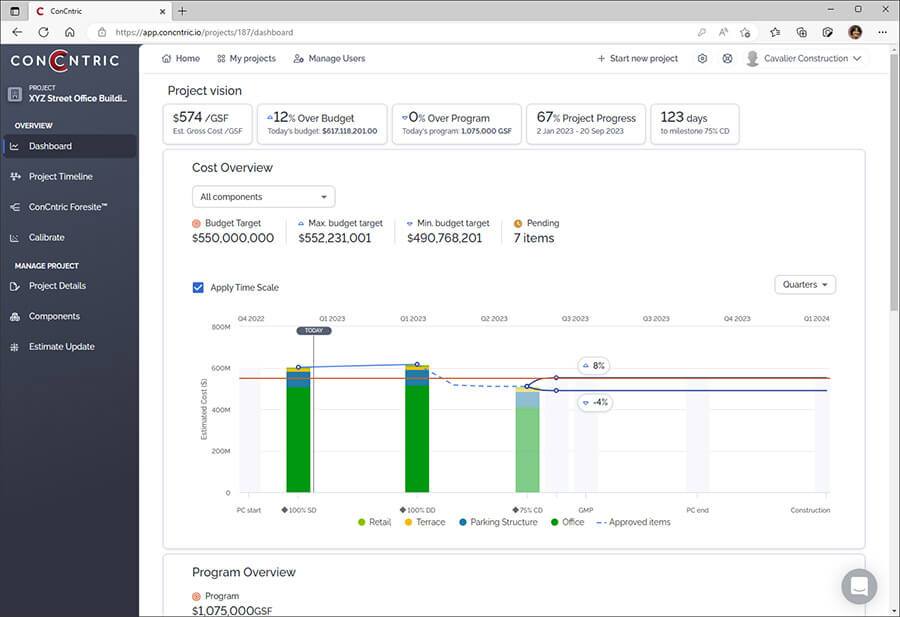

ConCntric is a comprehensive preconstruction platform unifying design, estimating, value engineering, scheduling, and bid package development in one system – a single source of truth for GCs, owners, and design teams.

Key integration: ConCntric bridges preconstruction to bidding through Autodesk's BuildingConnected. Use the Bid Package Development module to create detailed scopes (trade breakdown, estimates, negotiation targets, drawings, specs), then automatically transfer everything into BuildingConnected's ITB system – minimal re-entry, fewer errors. Track buyout progress and packages out for bid directly in ConCntric.

Core Features & Key Benefits Of ConCntric Include:

- Comprehensive Precon Suite: ConCntric isn’t just for bidding – it covers estimating, budgeting, value engineering, scheduling, and risk management in the preconstruction phase. From conceptual design through final estimate, teams can collaborate in one platform, running what-if scenarios and tracking changes. This broad capability appeals to builders who want to eliminate siloed spreadsheets and manage everything up front.

- Bid Package Development: A dedicated tool to streamline creating bid packages and scopes of work for subcontractor buyout. GCs can break down the project by trade, attach all relevant drawings/specs to each package, and define expectations (like target prices or key dates). ConCntric then prepares these packages for bidding. This structured approach reduces omissions and ensures each trade’s ITB is well-defined.

- BuildingConnected Integration: Rather than maintaining its own subcontractor network, ConCntric leverages the huge BuildingConnected network for subcontractor outreach. The platform automates project creation in BC and pushes all bid package details over with one click. In practice, your team uses ConCntric for planning and scope prep, then uses BuildingConnected’s interface to actually invite subs and collect bids. The benefit is a seamless data flow – no double entry – between precon planning and bid management. (ConCntric also integrates with other Autodesk tools like BIM 360 Docs for drawings, ensuring all data stays synced.)

- Collaboration & Insights: Because ConCntric centralizes so much information, it provides powerful dashboards and reports. Teams get a dynamic view of ongoing work – for example, real-time visibility into how many bid packages are in progress, out for bid, or awarded. The system tracks milestones and team responsibilities, helping precon managers identify bottlenecks. This transparency keeps stakeholders (including owners and designers) on the same page early on. ConCntric essentially serves as the preconstruction command center, fostering data-driven decisions and risk mitigation before projects break ground.

ConCntric is built for large GCs wanting to manage everything from initial estimate to subcontractor buyout in one ecosystem. It excels in complex projects requiring tight collaboration and data continuity – budget, develop bid packages, and push invites through BuildingConnected in one workflow.

Trade-offs: Full benefits require team-wide adoption of both ConCntric and BuildingConnected. It streamlines internal processes but doesn't fix sub frustrations with BC's interface (mandatory logins, outdated contacts).

Best for: Enterprise-grade preconstruction needs. Overkill for: Teams just needing better bidding outreach – where Downtobid's focused approach, lower cost, and nimbler workflow deliver faster value.

ConCntric vs Downtobid: Features Compared

Both ConCntric and Downtobid help GCs manage the bidding process, but their philosophies differ vastly. Let’s break down how they compare in key areas, side by side:

1. ITB Management & Automation

Downtobid: Built specifically to streamline ITB outreach. The platform uses AI to scan your uploaded plans, instantly identify the trades needed, and draft invites tailored to each subcontractor.

GCs can select subs by trade and location from Downtobid’s suggestions and blast out personalized invitations in a few clicks. Automated follow-ups then keep everyone on track. The result is a faster invite process with less clerical work for your team.

ConCntric: Offers a more traditional ITB setup as part of its preconstruction workflow. You’ll create bid packages (scopes) in ConCntric, then publish them to BuildingConnected for distribution. This ensures consistency of information, but the actual invite emails and interface that subs see are via BuildingConnected.

There’s less emphasis on AI or personalization – invites are essentially standardized templates, and any custom touch must be added manually by the GC. ConCntric does sync with your estimating data (since it’s all one system), which is useful for internal alignment, but it doesn’t automate the outreach or craft messages dynamically for each sub.

Winner: Downtobid. If your biggest pain point is quickly herding subs and getting their attention, Downtobid’s automation and tailored messaging approach is superior. It was purpose-built to maximize ITB efficiency and engagement, whereas ConCntric’s invite process, while solid, is more conventional and tied to the limits of BuildingConnected’s tools.

2. Subcontractor Network & Coverage

Downtobid: Maintains its own verified subcontractor network of around 50–60k companies covering all major trades. This database is curated – contacts are verified regularly, and inactive emails are removed. GCs can easily filter and find subs by trade and geography, even beyond their personal rolodex.

Essentially, Downtobid gives you a ready-made pool of qualified subs and helps fill coverage gaps (for example, finding a last-minute drywall crew in a new city) without you scrambling.

ConCntric: Leverages BuildingConnected’s massive network (over 700,000 users nationally). In theory, this means you can reach almost any subcontractor out there who’s on BC. Need bidders in a new region or a niche trade?

The scale is unmatched. However, quantity doesn’t equal quality. BuildingConnected’s contacts are user-maintained; many profiles are outdated or incomplete. GCs often find that blasting an invite to 100 unknown subs yields poor results – many contacts bounce or the companies don’t actually do the work you thought they did. So ConCntric gives you reach, but you may have to spend time curating and verifying subs from that giant list, or rely on your internal database anyway.

Winner: Tie — Scale vs. Quality. If you need maximum reach to cast a wide net (e.g. for a public project or a remote location), ConCntric (via BC) offers an unparalleled directory of subs. But for most GCs, Downtobid’s approach of “smaller but vetted” is more practical – you’ll spend less time chasing dead leads and more time talking to real, interested subcontractors. Many find that a targeted list of reliable subs beats a spam blast to hundreds of unknowns.

3. Follow-up Tracking & Bid Responses

Downtobid: After invites are sent, Downtobid shines in tracking and follow-up. The platform provides a real-time coverage dashboard that shows each invitee’s status – who’s opened the email, who indicated they’re bidding, who declined, and who hasn’t responded. For those “no response” subs, Downtobid automatically sends courteous reminder emails at intervals, gently nudging them to reply.

This automation dramatically reduces the manual chasing GCs usually have to do the week before bid day. By bid deadline, you have a clear picture of coverage: subs are neatly categorized as “Interested/Bidding,” “Not Bidding,” or “No Response”. This lets your team proactively fill any gaps (e.g. resend to a backup painter if two originally-invited painters opted out).

ConCntric: Because ConCntric hands off ITBs to BuildingConnected, the follow-up process is as good (or as limited) as it is in BC. BuildingConnected does allow subs to RSVP (they can click “I’m interested” or “Not bidding” on an invite), and GCs can see those responses on the BC bid list.

However, there are no automatic reminders built into BC’s basic workflow – it’s on the GC to note who hasn’t responded and then manually send follow-up messages or make calls. ConCntric itself doesn’t intervene in this, since once the bid is in BC’s court, ConCntric’s job is largely done until you import the bid results back.

In practice, many GCs end up exporting a list of non-responders and doing the old-fashioned follow-up hustle. This can lead to last-minute scrambles if subs go dark.

Winner: Downtobid. For GCs who want to “set it and forget it,” Downtobid’s automated follow-ups and live coverage tracking are game-changers. It significantly lowers the risk of discovering too late that you lack bids in a category. ConCntric, tied to BC’s more passive tracking, may still leave you making those 4:45 PM phone calls on bid day to see if a sub got your email. Downtobid simply offers more peace of mind that your bases are covered without constant micromanagement.

4. Platform Scope and Integrations

Downtobid: Focuses on pre-bid tasks only. It’s intentionally a lean tool – you use it to manage ITBs and subs up until bids are received. It does not handle project scheduling, project management, or detailed cost estimating.

There are minimal integrations needed because Downtobid is meant to slot into your process just for bidding. (That said, it’s building out integrations to export data to other project management systems, but its core is narrow.)

The upside is that it’s very easy to deploy and use; the learning curve is small and you’re not paying for features you don’t need. The downside is if you were hoping for a single software to carry you from bidding through project execution, Downtobid alone isn’t that – you’d still use other tools for takeoff, estimating, PM, etc..

ConCntric: Covers a far broader scope of work. Its value proposition is the unification of all preconstruction workflows on one platform. That means ConCntric touches everything from the initial budget and design coordination (with modules like Target Value Design and Idea Library) to procurement planning and even hand-off to operations. It also connects with various Autodesk Construction Cloud products (e.g. BIM 360 for drawings, ProEst for estimating data, etc.), acting as a hub in a larger software ecosystem.

The obvious benefit is data continuity – fewer errors from transferring info between disparate tools, and better collaboration across departments. For example, the estimate you finalize in ConCntric directly informs the bid package scopes and even subcontractor selection criteria. However, the breadth means ConCntric is heavier to implement.

It may require process changes, training across multiple modules, and buy-in from teams beyond just estimating (design managers, executives, etc.). It’s a long-term platform investment.

Winner: Depends on Your Needs.

ConCntric suits organizations wanting to consolidate preconstruction processes into one system with executive-level insights across all activities. It delivers big-picture value but requires significant time and investment.

Downtobid is ideal for teams needing a best-in-class bidding tool that plugs into existing workflows – quicker ROI, no overhaul required. Many mid-sized GCs prefer specialized tools like Downtobid for bidding alongside their existing estimating and PM systems rather than adopting a monolithic platform.

Choose ConCntric for end-to-end preconstruction consolidation. Choose Downtobid to excel at bidding without disrupting everything else.

5. User Experience & Subcontractor Friendliness

Downtobid: Emphasizes a clean, intuitive user experience for both GCs and subs. For GCs, the interface is modern and straightforward – even first-time users can navigate creating a project, uploading plans, and selecting subs without extensive training. The software guides you with AI suggestions (e.g. “Trades detected: Plumbing, Electrical – find subs for these?”) so you’re not starting from scratch each time.

For subcontractors, Downtobid removes common pain points: subs receive a personalized email invite (so it stands out), they click a link and can immediately view the project documents in a neatly organized online planroom – no logins, no software downloads, no paywalls.

This frictionless access means subs are more likely to engage with your ITB because it’s easy for them. Downtobid essentially treats subs like valued partners, respecting their time (organized files, one-click access, respond via email options) which in turn improves your bid turnout.

ConCntric: Designed primarily with the GC and precon team in mind – it’s a powerful platform, but not as lightweight in terms of usability. Expect a more enterprise-style interface with lots of modules, menus, and data fields to set up. GCs will likely need training to fully utilize all features (ConCntric is often rolled out at the departmental level, with support from the ConCntric team). It’s a robust system, but the initial learning curve is steeper than with a focused tool like Downtobid.

For subcontractors, the experience is essentially the BuildingConnected experience: they get an invite via BuildingConnected and must log into the BC platform to see project details and download files. Many subs are already familiar with BC, but they often voice frustration about its UX – e.g. cluttered project listings and having to manage another login.

Furthermore, BC’s planroom isn’t as optimized: subs sometimes have to download large plan sets and hunt for their drawings, which can be time-consuming. ConCntric doesn’t directly ameliorate those BC usability issues for subs. In short, ConCntric’s UX is geared for comprehensive data management (great for internal teams that master it), whereas Downtobid’s UX is geared for speed and simplicity (great for busy estimators and subs who need to act quickly).

Winner: Downtobid. When it comes to day-to-day use, Downtobid’s simplicity and sub-friendly design give it an edge, especially for smaller teams or fast-paced bid environments. GCs report that subs are more likely to respond when using Downtobid invites, partly because it’s just easier for them. ConCntric isn’t “difficult” per se, but it is a sizable system – best suited for firms that will take advantage of its depth. If you value a consumer-grade, seamless experience that gets everyone on board quickly, Downtobid wins on UX.

6. Pricing & Overall Value

Downtobid: Transparent, subscription-based pricing that scales with your needs. Downtobid offers monthly plans and even a free tier/trial to lower the barrier to entry. For example, many GCs start on a Starter plan (around $150/month per estimator, according to user reports) and can upgrade to higher tiers as their usage grows. The key is you know what you’re paying upfront – there are no mandatory multi-year contracts or hidden fees for extra users.

Considering Downtobid’s automation can save hours of manual work and potentially help win more projects (by increasing bid coverage), the ROI can be realized even on the lower-cost plans. In short, it delivers high value for a relatively modest cost, and you only pay for the bidding functionality (which is exactly what you’re using it for).

ConCntric: Enterprise pricing model, typically requiring a custom quote. You won’t find a simple price sheet on ConCntric’s website – you have to schedule a demo and go through a sales process to get a quote (this often bundles in BuildingConnected if you aren’t already subscribed). Based on analogous software like BuildingConnected, expect a significant annual subscription. For instance, BuildingConnected Pro alone often runs $3,600 or more per year for a GC office, and ConCntric would be an additional platform on top of that.

Large GCs might spend five to six figures annually for ConCntric, depending on the number of users and modules. If ConCntric replaces several other tools (estimating software, scheduling tools, etc.), it could be cost-justified.

But if you were mainly interested in improving bid invites, it’s a bit like buying a Ferrari to commute down the street. Moreover, some users feel that BuildingConnected’s value has stagnated even as prices increased. ConCntric’s value is tied to how fully you utilize its expansive capabilities; if you only use it for bidding, the cost per bid managed will be quite high.

Winner: Downtobid for most, ConCntric if you leverage its full suite. For the average contractor focused on bid management, Downtobid is the more cost-effective choice – you get targeted functionality, pay a reasonable subscription, and can cancel or upgrade as needed. ConCntric is best for enterprises that will wring value from every module it offers (and likely have a sizable budget to invest in tech).

It’s not just the software fees either – consider the implementation and training effort as part of the “cost.” Downtobid’s quick setup has a fast payoff, while ConCntric’s broader system is a larger investment on all fronts. Bottom line: if you’re watching ROI on your bidding process, Downtobid delivers more bang for your buck.

Which Platform Should You Choose?

Both platforms have clear strengths, so the “better” choice truly depends on your business needs. Here are some guidelines to help you decide:

Choose Downtobid if:

- You need a fast, focused way to send ITBs and secure sub coverage without a lot of manual work. Downtobid’s AI and automation will save your estimators hours on every bid.

- Your priority is to increase subcontractor engagement and responses on bid invites. If past invites have gone ignored or you struggle with subs dropping out, Downtobid’s personalized outreach and follow-up features directly tackle that problem (often yielding higher response and bid counts).

- You don’t need a massive project management suite – you’re looking specifically to improve the bidding phase. Downtobid lets you do that without forcing you to change your other tools. It plays nicely alongside your existing estimating software or project management system.

- Access to a reliable subcontractor network is important. If you want to tap into new trades or regions with confidence that contacts are valid, Downtobid’s vetted network provides quality over quantity. This is especially useful for growing GCs who are expanding their sub base.

Choose ConCntric if:

- You are seeking a full preconstruction solution that goes beyond bidding. If your organization wants to unify estimating, cost planning, value engineering, and bid management in one platform, ConCntric can deliver that integrated experience. It’s ideal if you’re trying to replace several disjointed tools with a single source of truth for precon.

- You’re already invested in the Autodesk ecosystem (e.g. using BuildingConnected, BIM 360, or Autodesk Construction Cloud) and you want to enhance those with better precon planning. ConCntric will fit neatly by adding robust planning and then handing off to BuildingConnected for bids – smoothing out the workflow for teams that use those tools.

- Your projects are large or complex enough to benefit from advanced collaboration and analytics. ConCntric shines when you have multiple stakeholders (owners, designers, multiple estimating teams) and need to manage risk, track revisions, and communicate in real-time during precon. It provides a level of project oversight and detail that point solutions can’t match.

- Budget is less of a concern than process improvement. Simply put, ConCntric is a premium platform – you’ll choose it because the value of centralizing your preconstruction process outweighs the cost. If your firm regularly manages big-budget projects and the cost of missing something in precon is huge, investing in ConCntric’s comprehensive approach can pay off.

Final Thoughts: Which Tool Is Right for You?

ConCntric offers a holistic preconstruction platform covering planning through bid award. Downtobid specializes in one thing: making bid invitations efficient and effective.

For most GCs, bidding is the critical bottleneck. If getting timely sub coverage makes or breaks your project bids, Downtobid is the better choice – it's purpose-built to boost response rates, cut admin work, and make subs want to bid. It's a nimble alternative for teams that don't need a full preconstruction suite but do need better bid results.

If your organization struggles with siloed data, estimate version control, or lack of integration across preconstruction phases, ConCntric's comprehensive approach might justify the investment.

Bottom line: "Better" depends on your priorities. For immediate bid management improvements and sub-friendly outreach, Downtobid wins. For enterprise-level preconstruction with bidding as one component, ConCntric delivers breadth. Some contractors use both – ConCntric for internal planning, Downtobid for external outreach – but that requires budget and commitment.

Choose the tool that solves your biggest workflow problem, and you'll streamline invitations, strengthen sub relationships, and win more bids.