A key performance indicator (KPI) is a simply a number that tells you whether or not you’re on track to achieving business goals. For example, revenue is typically the single most important KPI at most companies. The reason is if revenue goes up, then you’re likely doing well. If revenue goes down, then you’re likely not doing well.

Think of KPIs as a set of numbers that provide a quick snapshot for the health of your business. For construction companies, some common KPIs include number of safety incidents or project timeliness.

We work with a lot of subcontractors, specifically estimating teams. We’ve spent a lot of time understanding our customer’s processes and building software to make estimating workflows efficient as well as help estimating teams leverage their own data to achieve process improvement. Over time, we learned that many estimating teams actually struggle with defining good KPIs for measuring their performance, let alone tracking those metrics. For today’s post, we’ll define a core set of KPIs that we believe every estimating team should be tracking and the significance of these KPIs.

Key Takeaways

- Traditional KPIs like hit ratio don't provide actionable insights for improvement.

- Track qualified bids to identify growth opportunities being missed.

- Analyze bid portfolios by customer type to focus on core strengths.

- Follow-up percentage should be 100% as it directly increases win rates.

- Markup analysis helps calibrate competitive pricing strategies.

Overview Of Estimating Process

To start, let's quickly introduce the sales funnel that most estimating teams are familiar with.

Step 1: Capturing the bids

The first step is to capture all incoming bids so that you can decide whether or not you're bidding these opportunities. Typically, bids are collected through email and manually entered into a spreadsheet called a "bid board". Some companies like to use bid tracking templates or software like BuildingConnected's Bid Board Pro. Regardless, bids are typically captured in one central location so nothing slips through the cracks.

Step 2: Qualification

For most trade contractors, there is an excess amount of bids. In today's world, there are just so many emails coming from platforms like BuildingConnected, Procore, iSQFT and SmartBid. The problem is a lot of these bids are junk because they either come from unfamiliar general contractors or the project is out of state. The qualification step refers to step where estimating teams go through the bids one by one and decide which ones are worth bidding on. The key is to qualify the bids that are worth estimating and decline the ones that are not.

Step 3: Submittal

Once an estimator decides to prepare a bid, then the estimating process begins. The estimating team prepares takeoffs and sends quote requests to material vendors before finally putting together a proposal that gets sent to the GC.

Step 4: Win, Loss

After a proposal has been submitted, estimating teams will get a response back from the general contractor indicating whether they have won or lost the bid. At this point, it is important to analyze the reasons why you may have won or lost in order to improve your bidding process for next time.

Traditional KPIs And What's Wrong With Them

Most construction subcontractors track 4 simple KPIs:

- Total projects bid out

- Total revenue bid out

- Hit ratio by number of projects

- Hit ratio by revenue

While theat may be a good starting point, these metrics are flawed because they don't capture underlying factors that influence how well estimating is doing. Consider asking the following questions:

- What types of projects are we winning (interior fit outs, core & shell)?

- Do these projects match our company's core competencies?

- Who are our core customers and what is the bid hit-ratio for each of them?

- Are our core customers consistently coming back and awarding us more work each year?

- Do we have a diverse mix of customers or are we heavily reliant on just a few?

- How many opportunities are we declining each month that we could otherwise be bidding?

- How does our markup % influence our win ratio?

Notice how these questions dive deeper into themes like product competency, customer satisfaction and bidding process. The problem with KPIs around revenue and hit-ratio alone is that they're surface-level and don't really tell you how to improve. To truly innovate and stay competitive, you'll need detailed KPIs around key themes in the estimating process.

8 KPIs For Estimating

In this section, we outline 8 KPIs that will reveal deep insights into how well estimating is performing. Concretely, we'll define these KPIs, explain their significance, and provide some guidelines on how to use them for existing process improvement.

KPI 1: Number of qualified bids

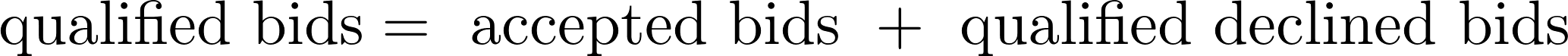

There are 3 types of bids (accepted, qualified declined, unqualified declined). Accepted bids are those that you have a good shot at winning. Qualified declined bids are those that you typically would accept but needed to decline because of various circumstances (deadline is too tight, not enough manpower to handle the job). Finally, unqualified declined bids are those that you would never bid (e.g. jobs from unfamiliar general contractors or out-of-state projects).

The formula for this KPI is as follows:

This number represents the entire market that you could potentially address under the best circumstances and will be relevant when considering growth plans (see below).

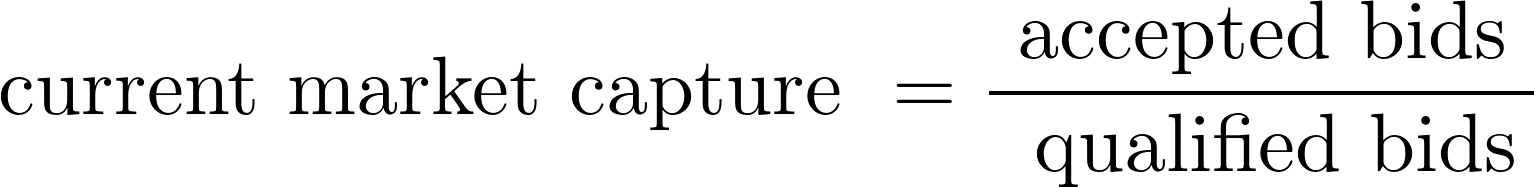

KPI 2: Current market capture

The formula for this KPI is as follows:

The current market capture is a percentage between 0 and 1 that represents what percentage of the market you have captured. For example, if this number is 0.1, then it means you're only bidding out 10% of all opportunities that you could potentially win. In other words, 90% of opportunities are being left on the table. Therefore, if your number is low, then it may make sense to hire additional staff to help capture more of the market. At the same time, if this number is high, then growing will mean you need to get creative about increasing the number of qualified bids. This can mean expanding out to new geographies or adding new product lines.

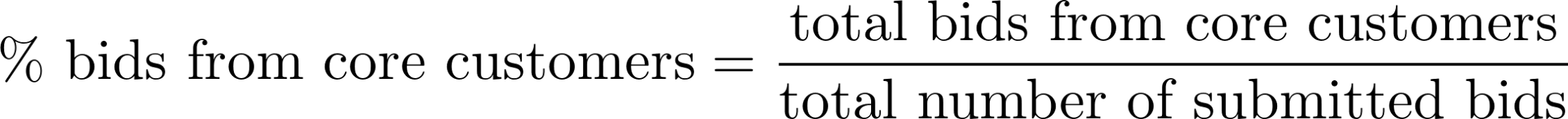

KPI 3: Portfolio of submitted bids

The bids submitted by your team represent the bids that have the highest chance of converting to job. These bids are the lifeblood of your organization and it's important to understand characteristics about these bids. Here are 3 questions you might want to ask

- What % of my bids are going to core customers vs not?

- What % of my bids are to hospitals vs commercial buildings or other product lines?

- What % of my bids have contract amounts of less than 25k, between 25k-100k and above 100k?

To calculate this KPI (e.g. for core customers)

Knowing these numbers provides a snapshot of how well you're satisfying core customers, how much you're emphasizing certain product lines and what the mix of contract sizes look like. This data arms you and your team to make strategic bets on how to grow in the future.

KPI 4: Portfolio of qualified declined bids

Note that the exact same analysis that you performed to calculate the portfolio of submitted bids should also be performed for your qualified declined bids. This gives you an understanding of what opportunities are being left on the table, which tells you what markets are available for you to grow into. In fact it's critical that you mark exactly why you declined a bid so that you could go back and analyze the available market. Common categories that you can consider adding to your analysis are

- Estimating did not have time

- Project too large or complex

- Outside of geographical area

- Union work

- Wrong type of work

- Unfamiliar general contractor

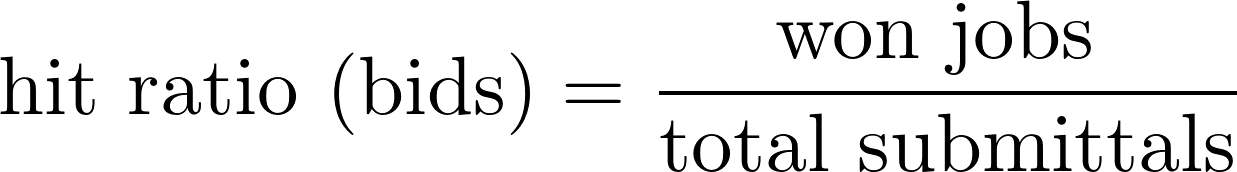

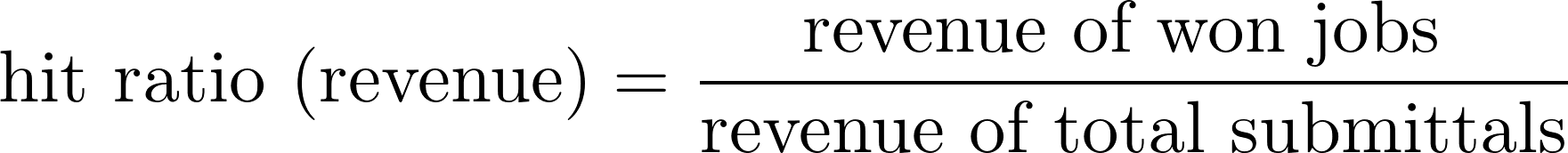

KPI 5: Hit ratio

Hit ratio is one of the most common KPIs for estimating and it represents the % of estimates that eventually become jobs. To dive deeper, however, you'll want to focus on additional KPIs that will help hit ratio go up (see follow up % and markup %).

The formula for this KPI is as follows:

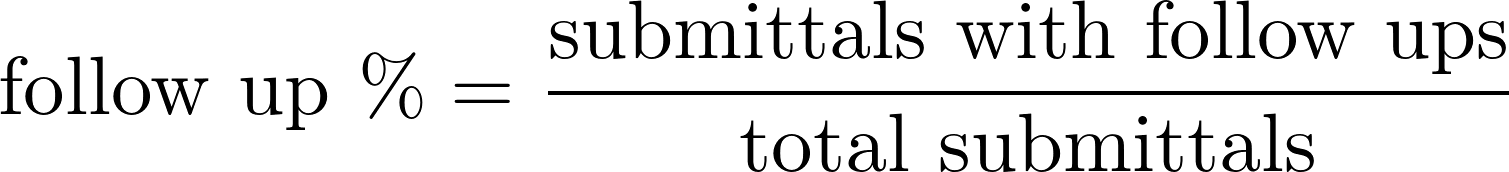

KPI 6: Follow up %

Time and time again, we learned that estimating teams who follow up with their GCs are more likely to win jobs. Follow ups not only help build relationships with GCs, but can also help your team potentially catch instances of missed scope. Multiple specialty trade contractors have mentioned that they've previously missed scope, caught it during a follow-up call and resubmitted a better bid back to the GC. Ideally, this KPI should be 100%, which means you're following up after every job.

The formula for this KPI is as follows:

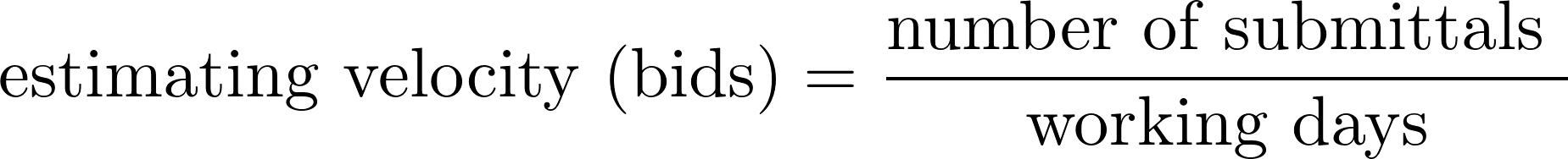

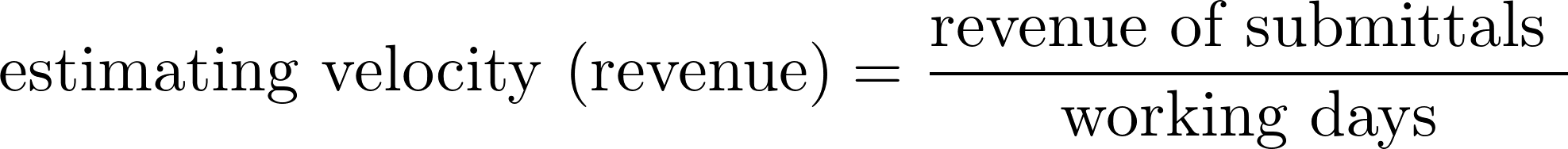

KPI 7: Estimating Velocity

Estimating velocity refers to the speed at which the estimating team puts out bids. There are two ways to calculate this number. The first way is by how many bids the estimating team submits each month. The second way is by how much revenue the estimating team submits each month.

The formulas for this KPI are as follows:

This KPI provides two insights. First, you can build processes and purchase software to increase this number because more bids submitted means more shots on goals. Second, this number provides a rough estimate of how much productivity you can expect out of a new estimator. This insight is important as you consider the cost-benefit tradeoff of potentially growing the team.

KPI 8: Markup %

The markup % influences how competitive a bid will be. If your markup % is too high, then won't be competitive. If your markup % is too low, then you risk leaving money on the table or worst losing money on the job. When submitting bids, you'll want to be tracking your markup percentages. Every few months, you'll want to look at all the bids won and look at the range of markup %s (do this for lost bids as well). To understand if there are trends between the markup % and bids you won and/or lost, consider calculating these metrics.

- Average markup % (wins vs losses)

- Median markup % (wins vs losses)

- Variance of markup % (wins vs losses)

The numbers alone don't tell the entire story, but they provide a signal for how your markup % influences wins and losses. This helps calibrate estimating which leads to price more competitively.

Conclusion

Well designed KPIs are powerful because they offer a very clear picture of whether or not your estimating team is improving. However, defining the metrics is only step 1. The next step is to implement and develop processes to track these KPIs and improve them.

If you're not already using a bid-tracking system like basis to organize your data or automatically perform follow ups then you're leaving dollars on the table. At basis, we're building software to help specialty trade contractors all over the country estimate more efficiently and capture valuable data. If you're ready to level up your estimating team then get in touch!

Frequently Asked Questions

What exactly is a KPI and why does it matter for estimating teams?

A KPI, or key performance indicator, is simply a number that shows if your estimating team is hitting business goals. It’s like a quick health check for your bidding process. For example, tracking qualified bids helps you see missed growth chances while follow-up rates show if you’re building strong GC relationships.

Why are traditional KPIs like hit ratio not enough?

Hit ratio counts wins vs bids but misses deeper insights like the types of projects won, if they fit your core strengths, or whether your pricing is competitive. Good KPIs dig beneath surface numbers so you can improve your bids strategically, not just boost volume blindly.

What are some must-track KPIs for modern estimating teams?

Track qualified bids to know your real opportunities. Measure market capture to see how much potential you’re bidding on. Analyze your bid portfolio to focus on profitable customer segments. Track follow-up percentage (aim for 100%) as it directly affects win rate. And don’t forget markup % to price competitively without losing margin.

How do KPIs translate into real improvement for estimating?

KPIs give you clear signals on where to focus. For example, a low market capture suggests hiring more estimators. Declining many qualified bids means untapped growth. Tracking markup % helps you find the sweet spot between winning bids and profitability. Together, KPIs help build smarter bidding workflows, optimize resources, and grow your business.