Most commercial estimators follow the same routine when bid day approaches. Despite access to thousands of contacts and subscriptions to industry platforms, familiar challenges persist. Emails bounce from estimators who changed positions months ago. Generic invitations compete with dozens of daily bid requests. Critical scopes remain uncovered while project deadlines approach.

The frustrating part? Most markets contain sufficient trade capacity, but locating current contact information for responsive bidders requires significant time investment that estimators rarely have.

Downtobid’s subcontractor database addresses this gap. Before diving into what makes subcontractor database software actually work, let's look at why traditional commercial subcontractor lists keep letting estimators down.

Note: If you want to reach relevant subs with a verified contact list, try Downtobid. Upload your plans and let the AI identify scopes, match trades to specialists, and send personalized invitations that actually get responses. Test the platform with a free trial here.

Key Takeaways

- Old sub lists fail with bounces and ignored invites; Downtobid fixes it with fresh data.

- Downtobid’s AI matches 57k verified subs to scopes, slashing manual work and boosting 43% open rates.

- It beats legacy tools like SmartBid and BuildingConnected with auto-follow-ups and no-login planrooms.

- Gaps remain in bid-leveling and deep ERP ties—pair it with your existing stack.

- Test Downtobid’s trial now to cut chase time and win smarter bids.

Why The Traditional Commercial Subcontractor List Fails

Most commercial GCs maintain a subcontractor list—often a mix of Excel, Outlook contacts, and data generated by bid platforms. On paper, those lists look large enough to cover every division. But when bid day nears, estimators still face familiar headaches:

- Emails bounce because contacts have moved on or firms have dissolved.

- Generic “blast” invites draw few eyes; subs receive dozens daily and ignore the ones that don’t speak to their trade.

- Even after a round of calls, key scopes remain uncovered, forcing last‑minute outreach that weakens negotiating leverage.

Legacy directories like ConstructConnect’s network or SmartBid can help locate names, yet their size comes at a cost—self‑managed profiles go stale, and filtering 80 thousand contacts for a single HVAC quote wastes hours. The underlying problem is data fidelity and the time required to turn raw contacts into responsive bidders.

Downtobid’s Subcontractor Database: What Differs

Our bidding tool approaches the database problem with two guiding principles: keep the list clean and treat outreach as a data problem, not a mail‑merge.

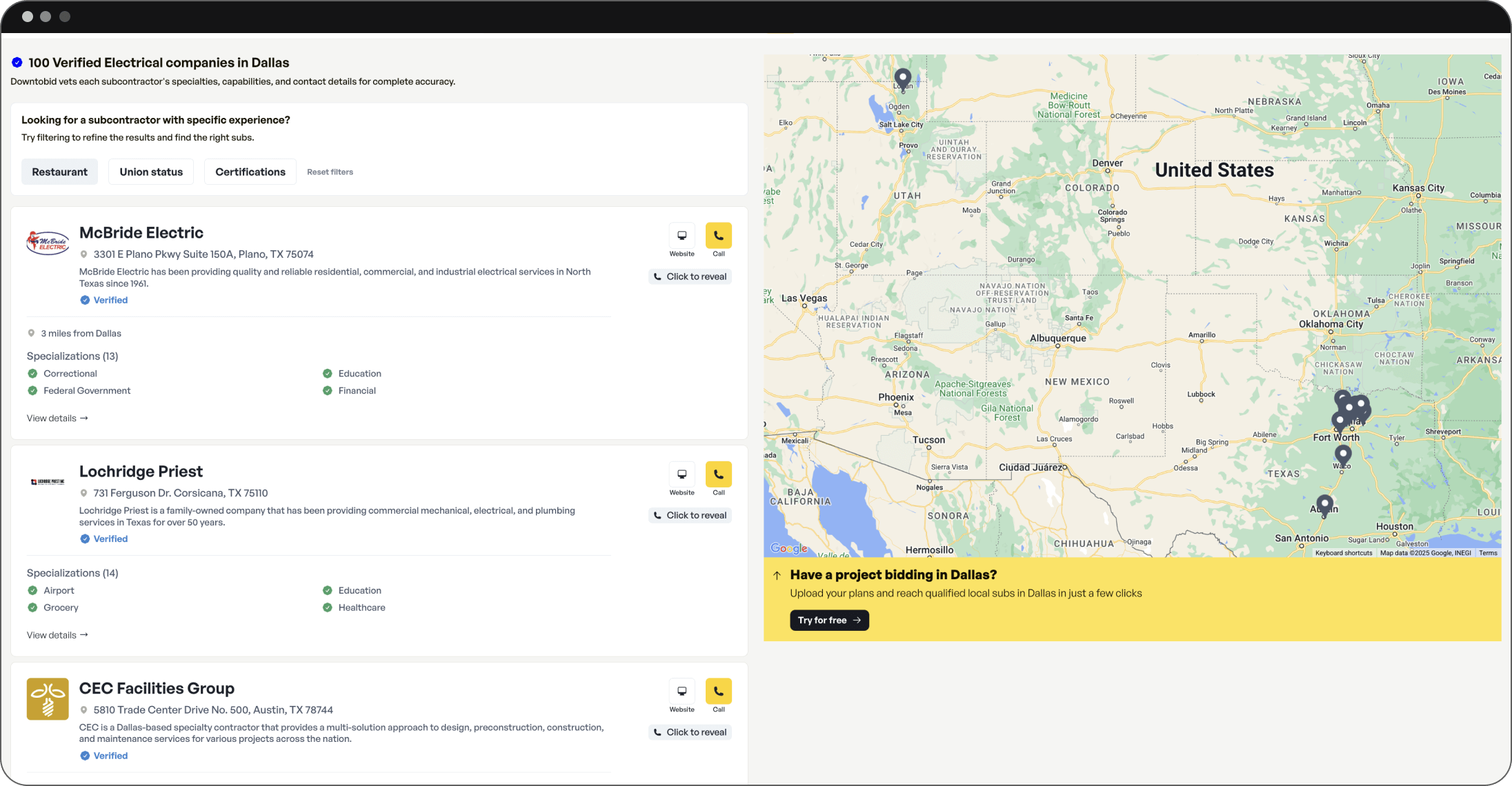

Every subcontractor profile passes a verification routine—company status, primary contact, trade classification, geography—before becoming visible to GCs. The system flags dormant or returned emails and removes them automatically. In practical terms, a GC running a search today sees only firms that exist and are reachable, not entries that moved addresses three years ago.

With over 57,000 active profiles, Downtobid covers every trade in every market without the bloat—no dead contacts, no wasted time.

Verification solves one half of the equation. The second half is relevance. When a GC uploads a set of plans, Downtobid’s machine‑reading model identifies sheets and notes tied to specific trades. If the drawings include extensive cold‑formed framing details, the platform suggests local framing contractors; it does not recommend carpenters who specialize in finish work. That trade‑to‑scope matching is the core AI feature. Instead of expecting GCs to comb the index manually, the system outputs a draft invitation list within minutes.

Advanced Verification Methods: How Clean Databases Are Built

Most subcontractor databases rely on subs to manage their own profiles. Result? Half the contacts are outdated and the other half are misclassified. Downtobid verifies every profile before it goes live.

Finding Everyone, Not Just Volunteers

Instead of waiting for subs to find the platform, Downtobid maps every contractor with a website across the country. This goes beyond basic Google Maps searches that most GCs rely on—the system identifies contractors who might never sign up for bidding platforms but are active in their local markets.

That means the local HVAC shop that's never heard of bidding platforms but shows up in local searches still gets included. The goal isn't building the biggest database—it's building the most reliable one.

Note: Try our free sub prequalification template to help you vet your contacts.

What the AI Finds

Once a potential sub is identified, automated tools visit their website and pull key details: what trades they actually do, where they work, union status, project sizes, recent jobs. If a company's homepage mentions "electrical" fifty times, the system tags them as electrical contractors. No guessing, no outdated classifications from 2019.

Getting Past the Front Desk

Sending bids to "info@contractor.com" is like mailing invoices to "Accounting Department"—someone might see it eventually. Downtobid digs deeper to find the actual estimators and project managers, complete with direct emails and phone numbers. The difference between reaching a receptionist and reaching the person who decides on bids is the difference between getting ignored and getting a quote.

This verification process takes more work upfront than letting subs manage their own profiles. But when bid day arrives, estimators see fewer bounced emails and get more responses. The database becomes a tool that actually works instead of another headache to manage.

Cutting the Dead Weight

The final step removes entries that look legitimate but waste everyone's time: manufacturer reps listed as contractors, companies working outside their service area, firms that haven't been active recently. It might shrink the total count, but every remaining contact is worth calling.

Checkpoint: Evaluate It in Your Own Market

GCs can test this workflow at no cost. A single‑project trial of Downtobid allows upload of plans, automatic scope extraction, and generation of a live invite list. The trial link is at downtobid.com/free‑trial.

Measurable Impact on Coverage For General Contractors

Early adopters report two quantitative shifts: fewer emails sent per awarded bid and higher open‑to‑quote ratios. In one Midwest GC study, the estimator reduced invite volume by 40 percent yet received the same number of competitive quotes because the list omitted out‑of‑trade contacts that never replied anyway.

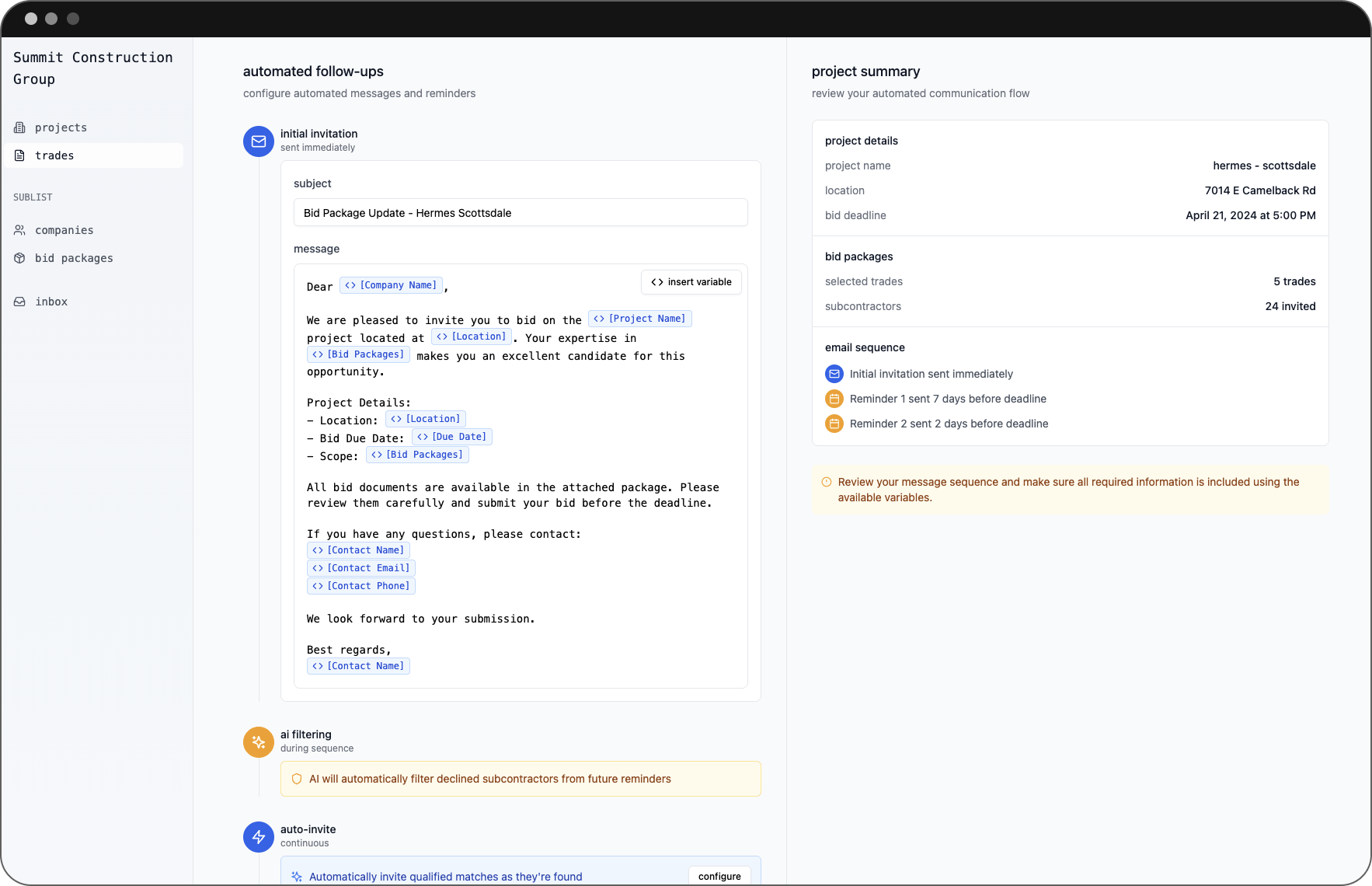

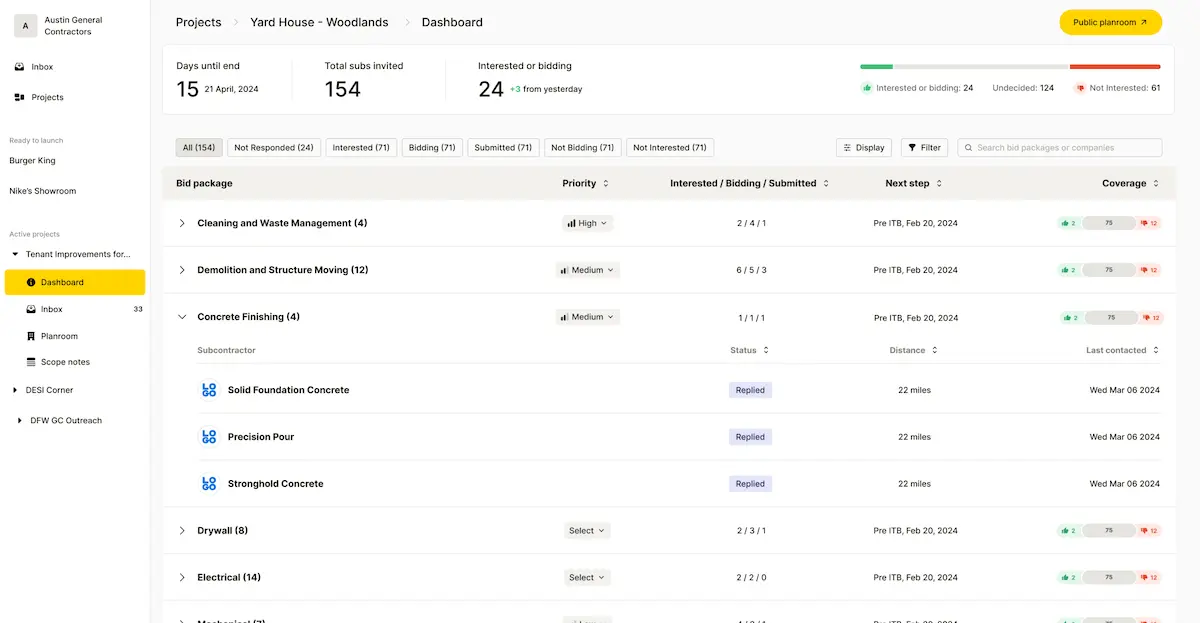

A separate Southeast GC tracked open rates: generic blasts averaged 18 percent, Downtobid’s tailored messages averaged 43 percent over three projects. The higher engagement was credited to two factors: subject lines naming the project type (“Medical Office | Electrical Scope”) and no‑login planroom links.

Those planrooms matter. Subs often cite logins as the point where they abandon an invite. Downtobid bypasses credentials entirely. Drawings appear in a web viewer, pre‑sorted into Plans, Specs, Photos, and each sheet is searchable by number and title. The platform can only guarantee time savings on the GC side, but subs confirm it eliminates “I couldn’t find the right file” excuses that delay quoting.

How It Compares to Established Tools

The subcontractor database market has plenty of options—several established platforms have been around for years and built solid user bases. Each tackles the same basic problems of keeping data current, getting subs to respond, and fitting into existing workflows, but they go about it differently.

Knowing what each tool does well and where it struggles helps GCs pick the right fit for their biggest headaches.

ConstructConnect / SmartBid:

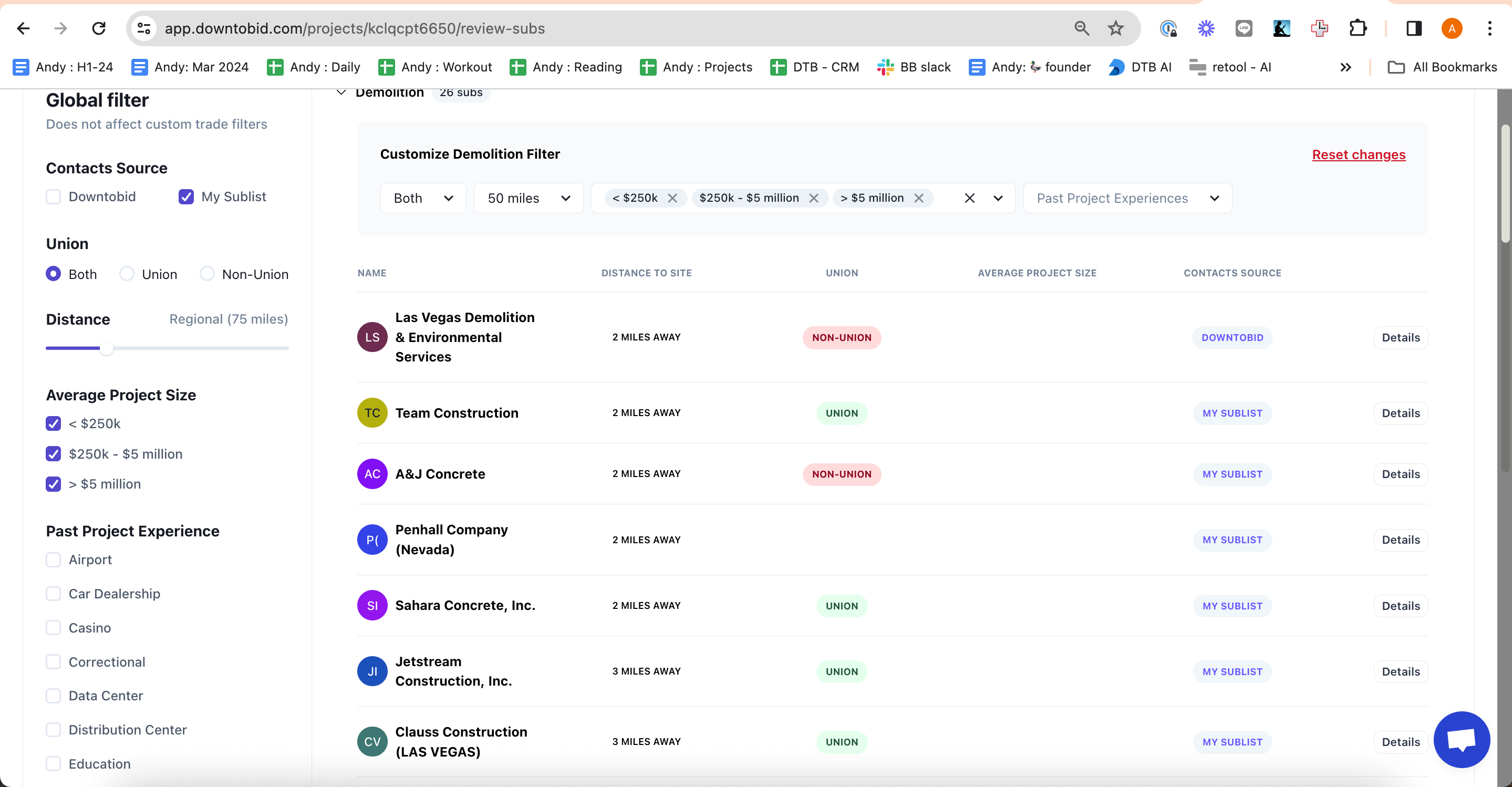

Large directory, high breadth, mixed data quality. Subs create and maintain their own profiles; accounts go stale when companies close. SmartBid sends ITBs efficiently but does not verify contacts or automate follow‑ups. GCs must track opens and phone subs who do not respond.

BuildingConnected (Procore):

Robust communication logs and integration with Procore’s PM suite. Mass invites easy to configure, yet many subs ignore the platform‑generated emails unless they already know the GC. Data updates depend on subcontractors logging in and editing profiles. Compare the Downtobid Network vs BuildingConnected's subcontractors.

Downtobid:

Smaller but curated subcontractor network—verification handled by the platform. AI assigns trades to relevant subs and writes scope‑specific invite text. Automated reminders reduce manual chasing. Planroom requires no login, which has shown higher engagement among subcontractors who avoid portal fatigue.

Each tool tackles a slice of the workflow. GCs whose biggest pain is bid‑day leveling might favor BuildingConnected’s analytics or pair SmartBid with Sage BidMatrix. GCs whose pain is initial engagement and data reliability may find Downtobid removes more friction up front.

Practical Workflow for GCs

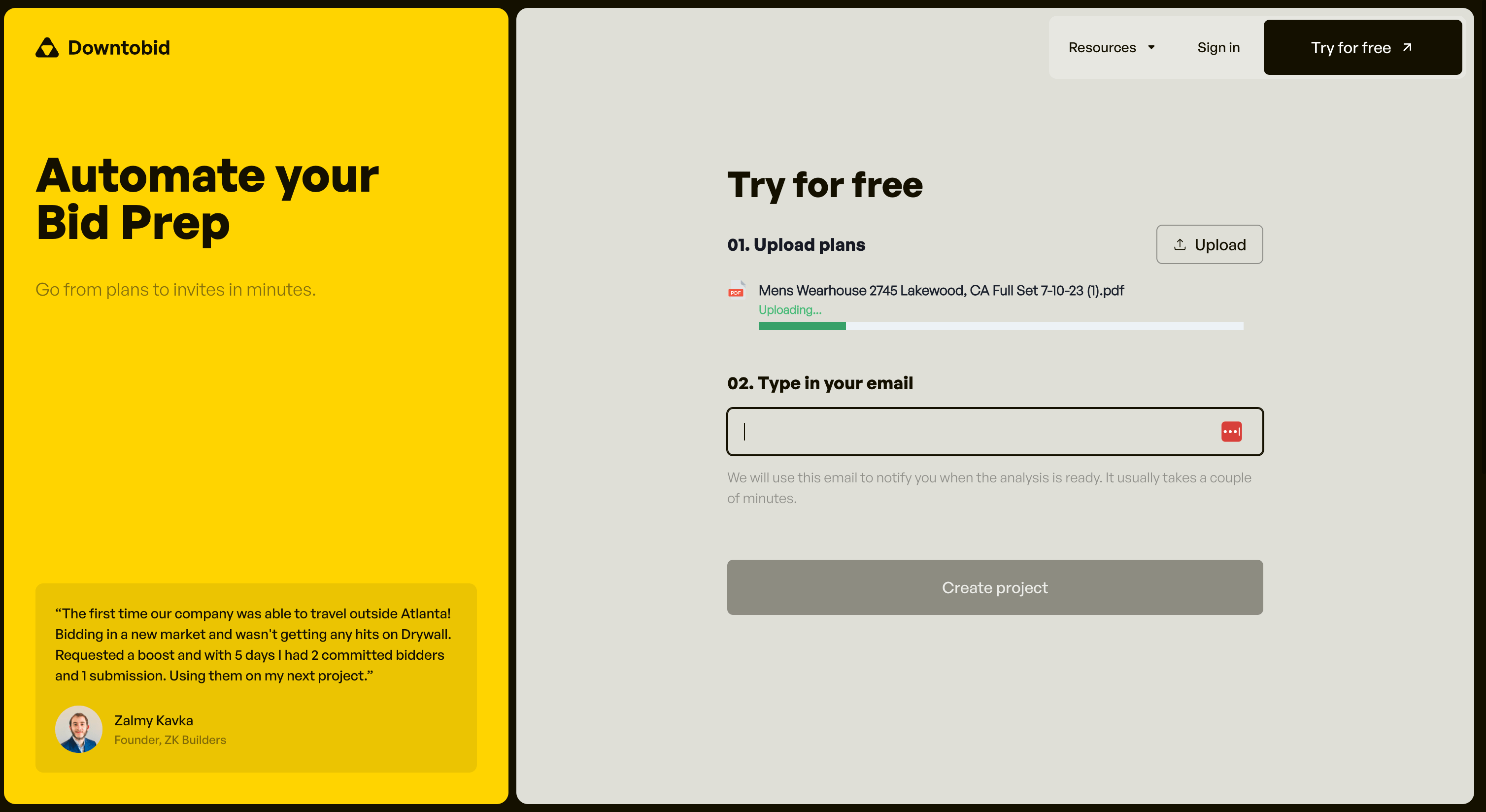

- Upload Drawings – A 300‑page PDF set goes in; within minutes the AI returns a list of trades detected (e.g., electrical, fire suppression, curtain wall).

- Review Suggested Sub List – Estimator sees 10–20 firms per trade, filtered by distance and trade specialty. Contacts are recent; bounced emails rarely occur because stale entries are culled weekly.

- Send Personalized ITBs – Emails include project summary, bid deadline, and a scoped paragraph. Subcontractors click a link to open drawings instantly—no account setup.

- Automatic Follow‑Ups – Silent subs get polite reminders at configurable intervals. The GC dashboard shows open, viewed, bidding, and declined statuses in real time.

- Export Coverage Data – Once subs confirm, the coverage board can export to Excel or a PM platform; Downtobid continues to log activity until bid day.

GCs report that steps 1–3, which traditionally consumed a full afternoon per project, now fit into an hour block. The biggest shift is psychological: estimators spend time reviewing scope accuracy instead of wrestling with email lists.

Where It Still Needs Work

Downtobid is not yet the hub for bid‑day number crunching. It can flag unresponsive trades, but selecting the optimal combination of bids still happens in Excel or a dedicated leveling tool.

Its integration catalog is shorter than older platforms; QuickBooks Online sync exists, but deep links to large ERPs are limited. For firms with heavy enterprise stacks, that may be a constraint.

Downtobid’s development roadmap points to incremental integrations rather than a single massive release. GCs with bespoke workflows should evaluate how data exports fit into their ecosystem.

Summary

Data decay and impersonal outreach remain the two biggest drags on subcontractor bidding. Downtobid addresses both. A continuously verified contractor list reduces bounced emails, while AI‑generated scope matching and no‑login planrooms give subs a clear reason to respond. GCs see fewer gaps, less manual follow‑up, and faster coverage on every trade.

The one platform does not replace specialized bid‑leveling construction software or large ERP connections—areas where legacy tools still lead—but it narrows the funnel efficiently, ensuring a reliable set of bids reaches the estimator’s desk.

Commercial general contractors interested in testing real‑world response improvements can upload a project through the Downtobid free trial and measure engagement side by side with existing methods. In an industry where time lost to chasing dead contacts translates directly to risk and higher numbers, a cleaner, smarter database is more than convenience; it’s a competitive lever.